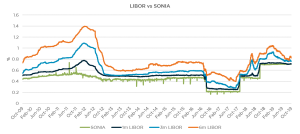

The transition of loans that  are currently linked to LIBOR (London Inter-Bank Offer Rate) onto its replacement, SONIA (Sterling Overnight Index Average) is now well progressed and banks are managing this process well it seems. Each have produced useful guidance notes for borrowers that are affected and setting out the options available to them as part of the process.

are currently linked to LIBOR (London Inter-Bank Offer Rate) onto its replacement, SONIA (Sterling Overnight Index Average) is now well progressed and banks are managing this process well it seems. Each have produced useful guidance notes for borrowers that are affected and setting out the options available to them as part of the process.

The challenge is that in many cases (perhaps understandably) they seem to have focussed on the larger borrowers and they, of course, have Treasury expertise and full-time FD resource. All the terminology will be familiar to them and they have the capacity and capability to model the implication of making decisions on options such as whether to use the 5-year historic median CAS (5YHM) or a ‘Forward CAS’, and what ‘Switch Date’ to choose.

LIBOR has however been used with loans for many borrowers who don’t have this capacity and capability. It has been common with many property loans and some commercial loans for trading businesses. To busy property investors and SME’s, having to take on this information and make decisions is, at the least, a distraction, but it could also be concerning (and as many will not understand the issue, and the banks are pushing to get things done by the year-end deadline, it could also feel a bit ‘threatening’).

The issues involved appear complex but once understood the options for borrowers can be straightforward and a degree of trust in the banks is important here also. Another level of complexity does come into this process when borrowers have IRH (Interest Rate Hedging) alongside their loans but they are probably in the minority now at SME levels.

It is possible for SME’s to get advice on this if they don’t understand it or just want to save themselves some time in trying to get a sufficient understanding of how their loans (and future borrowing costs) will be affected.

Bankers should also be attaching the right priority to those that need and deserve more support on this, rather than ensuring that the largest Corporate loans are transitioned according to the deadline.