In the world of ‘Real Est ate’ and ‘Corporate’ finance there seems to be activity and communication about the replacement of ‘LIBOR’ with ‘SONIA’. But less so in the SME sector, where I have had minimal enquiries from companies that will be affected by this, despite it being a relatively complex subject.

ate’ and ‘Corporate’ finance there seems to be activity and communication about the replacement of ‘LIBOR’ with ‘SONIA’. But less so in the SME sector, where I have had minimal enquiries from companies that will be affected by this, despite it being a relatively complex subject.

Obviously, the banks are going to put their energies first into the larger borrowers, and fewer SME’s will be affected by it anyway (it tends to apply to ‘larger’ loans). However, some will, and they will not have the in-house ‘treasury type’ expertise of the larger borrowers, and historically they are left behind by the banks in the communication of such changes. They are also likely to trust the banks to implement such a change without seeking to fully understand it (because they have other things to spend their limited time on perhaps)

To recap on the change: LIBOR (‘London Interbank Offer Rate’) has been used for many years by banks as an alternative to ‘Base Rate’ for larger loans (banks vary but typically the threshold could be £500k). The reason being that this has better represented their true ‘Cost of Funds’, because they borrow in the money markets rather than from the Bank of England (who set their ‘Base Rate’ as what they would charge the banks to borrow from them if they had to). LIBOR has however come to the end of its usefulness, not least as it has been discredited due to the ‘libor rigging’ scandals. It was also not an ideal measure, because it was based on hypothetical, aggregated predictions of ‘how much would you charge to lend to this bank today’.

It is being replaced with SONIA (‘Sterling Overnight Index Average’) with an implementation date of the end of 2021. SONIA is based on an aggregated measure of what has ACTUALLY been charged on real transactions, so it has a ‘backward looking’ nature to it. Clearly it is more reliable, but it does rely on volumes of actual lending which may of course fluctuate in the market.

The practical issue is that companies with SONIA based loans will have to make key decisions about how they want their interest charged and will also need to understand how it is calculated for their own bespoke loan. Some may just trust the bank to calculate the interest accurately, but Corporates Treasurers will be doing their own calculations and certainly checking the banks figures. SME’s may not have the resources or motivation to do that.

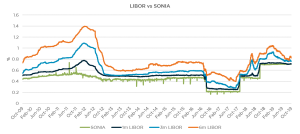

Predicting SONIA as a reference rate will also be more difficult than with LIBOR, which fluctuates less than SONIA historically (SONIA has actually been around for years but not used much). This means that forecasting will be more difficult for SME’s and that could affect cashflow and even Covenant tests.

Some ‘scaremonger’s’ were predicting that this could be the PPI of Investment banking, but good progress is being made on this now and the Facility Letters that I have seen, which are based on SONIA, make arrangements clear (although the borrower has some decisions to make still).

There also has to be a transition period, as existing loans based on LIBOR will need to migrate onto new terms. Again, for the larger facilities the loan documentation has been providing for this for a while. SME’s are not hearing so much about this it seems.

My recommendation:

- SME’s who have existing loans based on LIBOR should be proactive in asking their banks/lenders what the transition arrangements are.

- SME’s taking out new loans should make the effort to understand the basis of interest charging and the implications of it on cashflow, before they make the decisions that the bank will need them to apply to their loan (such as charging periods)